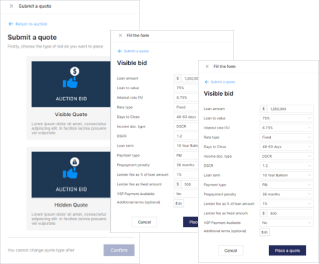

We built the industry’s first loan quoting arena where lenders compete “live” for your loan. Go beyond matchmaking or pricing engines because in the Starport arena deals are reviewed, negotiated, and quoted in one place at one time by all the right lenders in as little as 90 minutes.

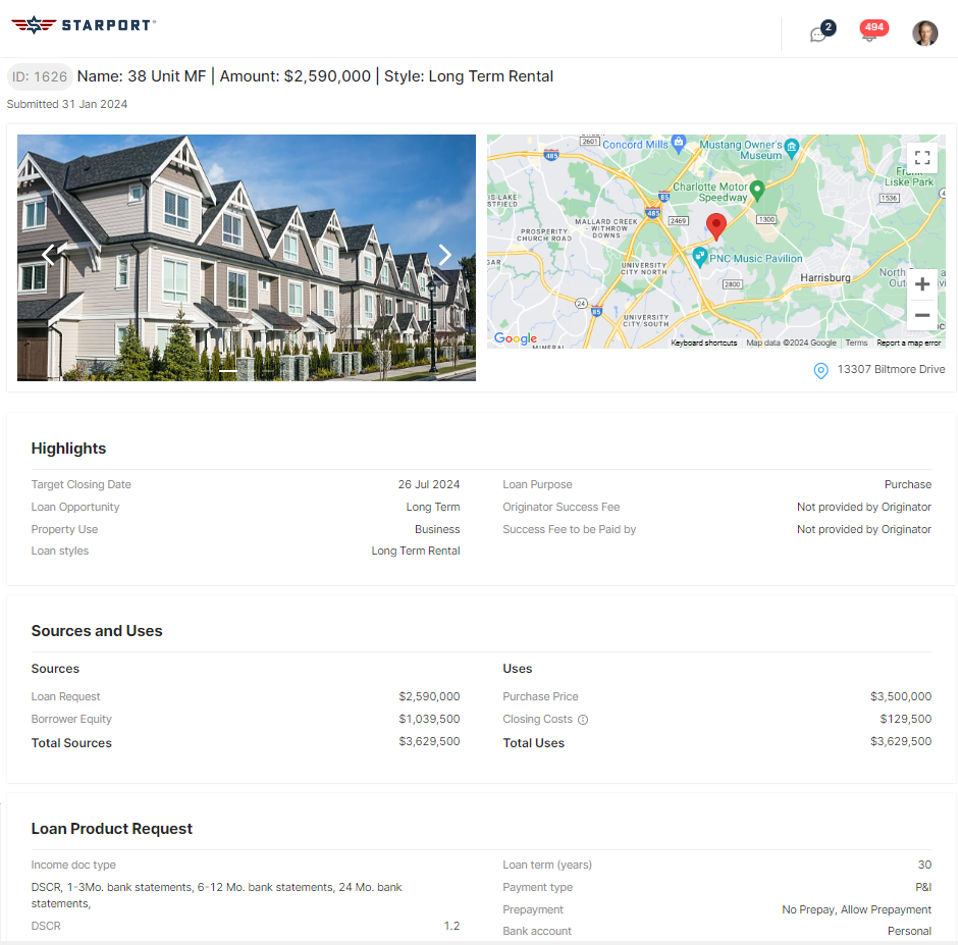

Set your deal up the correct way. Our clear, concise, professional deal profiles are preferred by lenders large and small because they contain all the key info in all the right places.

You don't want your deal shopped to 1,000s of lenders. On Starport our AI will identify and invite only the right lenders so your deals remains private , secure, and in-demand.

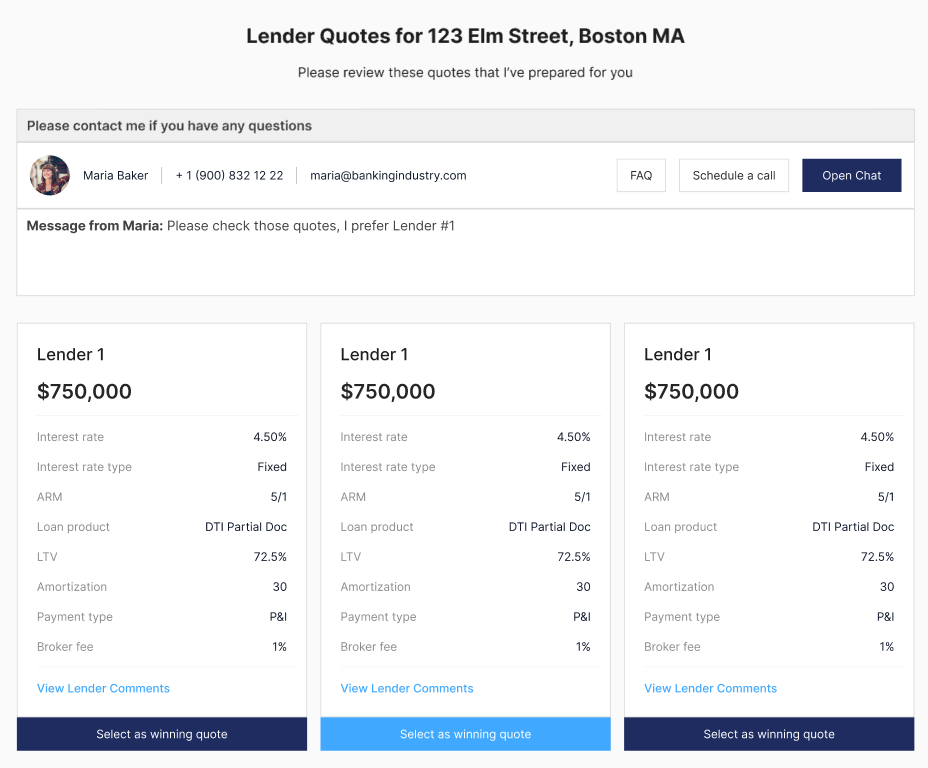

Evaluate all your quotes with analytical tools that make the maze of loan terms easy to understand for everyone so you select the best loan to maximize profits and minimize risk.

Gather and manage diligence documents like a zen-master with ADG - Starport proprietary automated document gathering system that gets you to a closing faster with less hassle.

Starport offers more than tech. Our team of mortgage experts is ready to help you navigate the loan process from start to finish.

Speak to

a mentor

Average 20+

years experience

Available

weekly

Friendly

& Helpful

No. We are a technology platform that connects you directly to lenders. But we know that sometimes speaking with a human mortgage expert can be helpful. That’s why we employ a team of seasoned mortgage professionals that are available to discuss your deal.

We have a team dedicated to developing new lender relationships in the biggest cities as well as small towns across America. When we approve a new lender to join Starport, the lender enters detailed 16-point mandates to describe each of their loan programs. Our AI engine scores your deal against 100s of lender mandates in seconds and invites only the most relevant lenders to view your deal.

We work with investors seeking commercial and residential property loans on all property types. We are unique because in addition to traditional real estate lenders, we have built a nationwide network of specialty lenders that can fund uncommon hard-to-fund deals.

There are no commitments and no subscriptions to use Starport.. We charge a small platform license fee which is due at closing and can be added to closing costs. Our interests are 100% aligned with yours because we don’t get paid until your deal gets funded.

And we're on a mission to make it easier to find a loan so you can focus on what really matters - finding the next great property investment and falling in love all over again.

Learn more