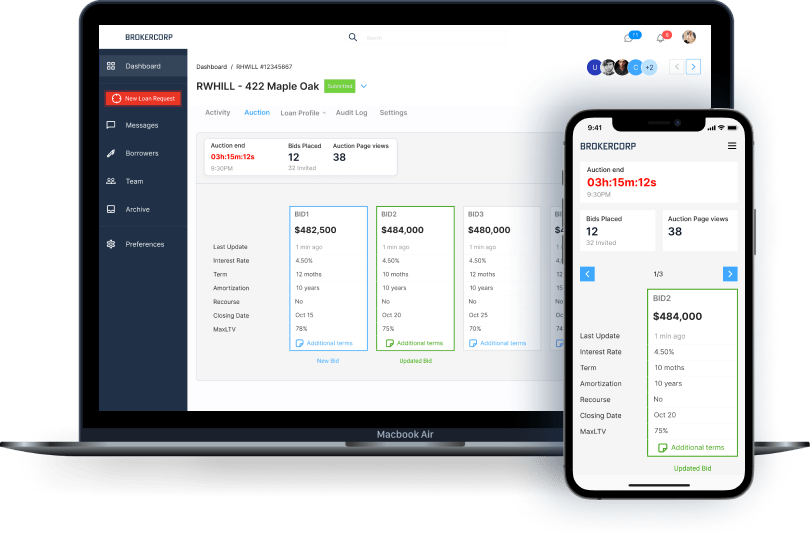

CONTEXTUAL & DIRECT COMMUNICATION

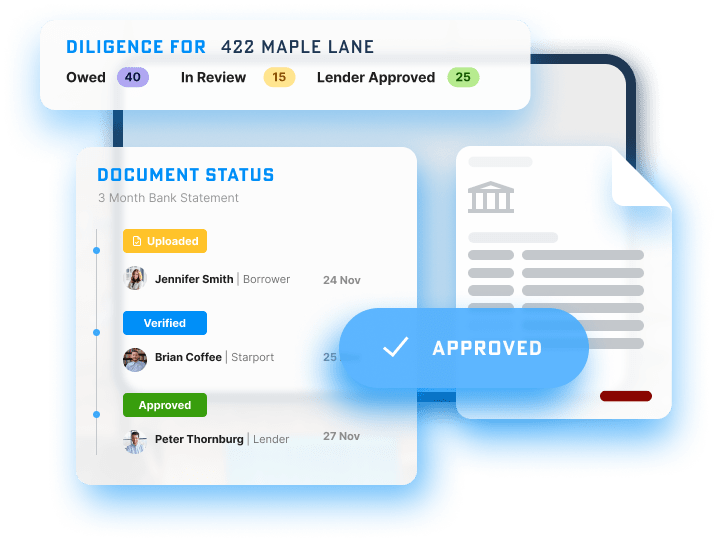

The days of endless email threads, dozens of calls, lost info and lost time are over. With Starport, each part of the origination process has built-in communication channels to clean up the mess. Discuss scenarios requests, loan quotes, and individual diligence items. You can even empower underwriting teams to get involved directly. It’s all made possible with the embedded communication tools we’ve created.